net operating working capital definition

Working capital is calculated as current assets minus current. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses.

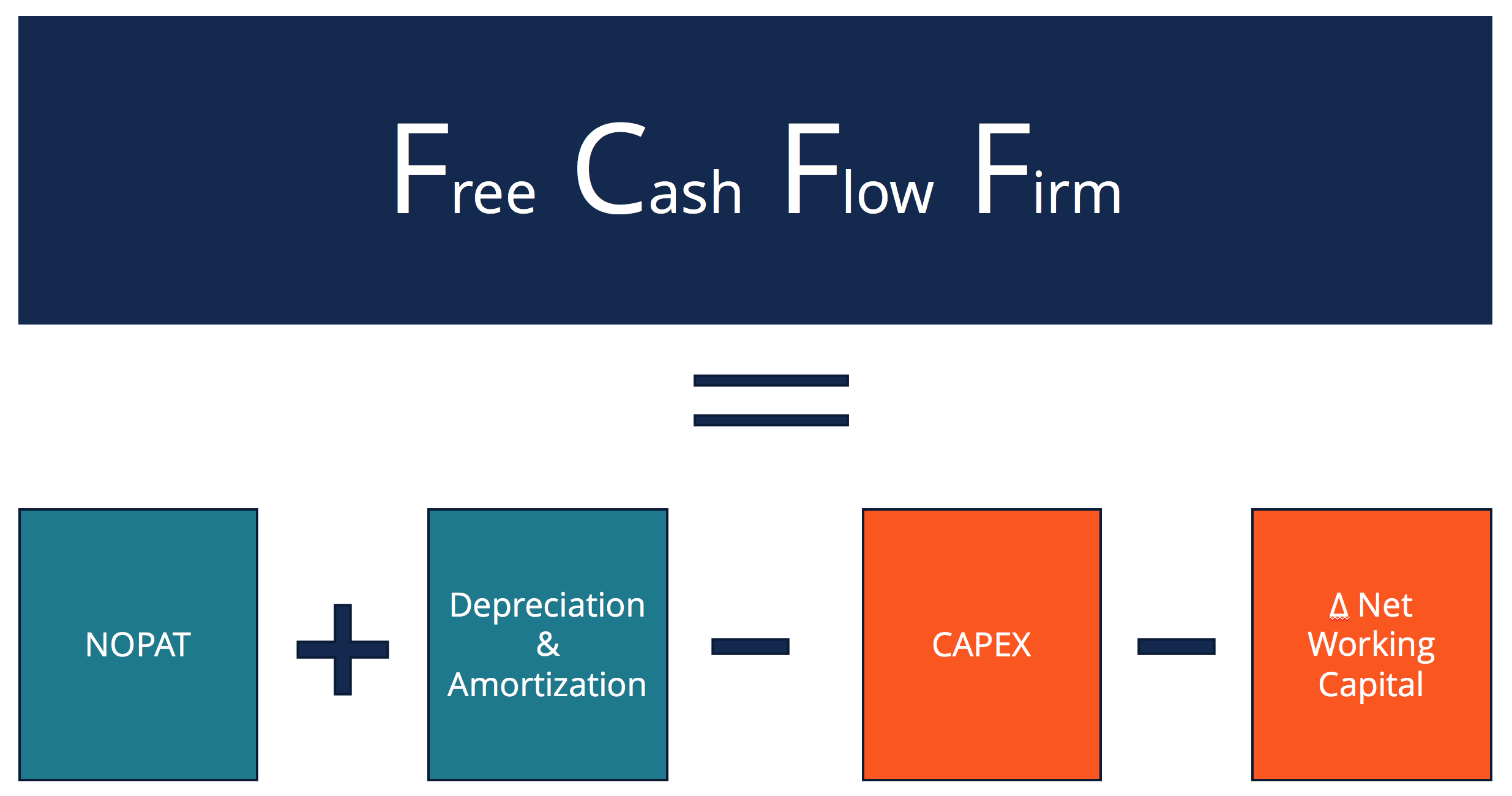

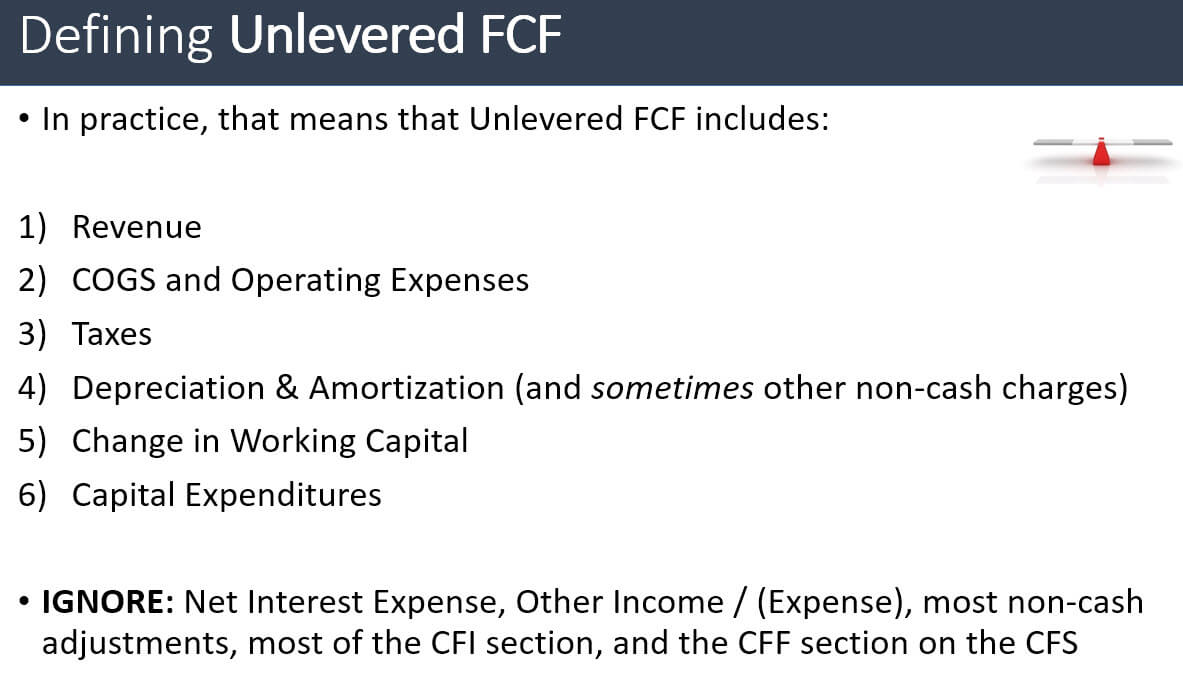

Free Cash Flow To Firm Fcff Formulas Definition Example

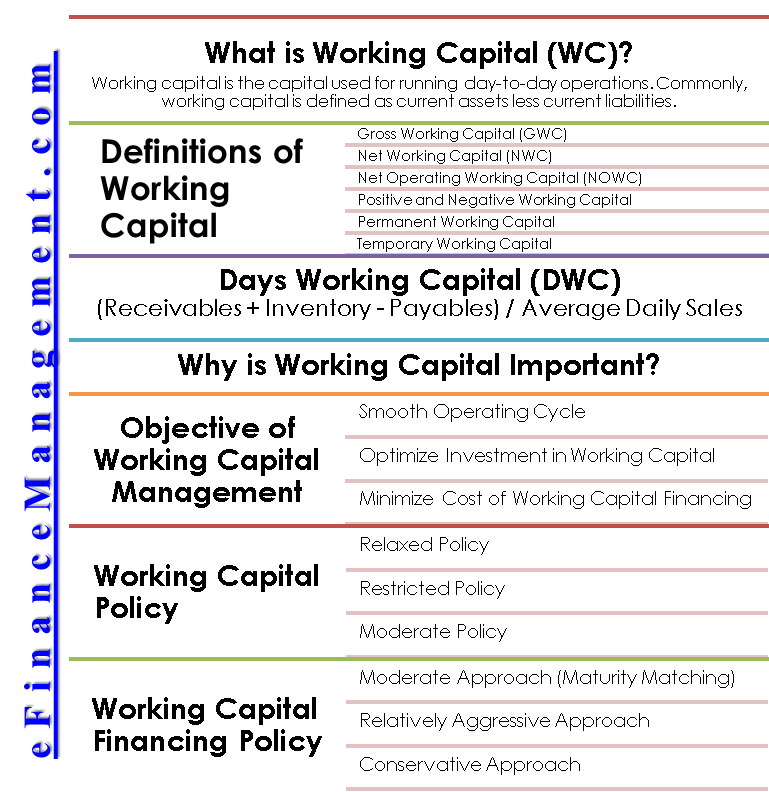

Working capital is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities.

. BBY using the following balance sheets. They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due. In the second step using equations 3 and 10 we calculate the values for the net operating working capital as defined in the statement of cash flow DELTA NOWCsubSCF and in the expression for the free cash flow measure DELTA NOWCsubFCF for the years 2012 to 2014.

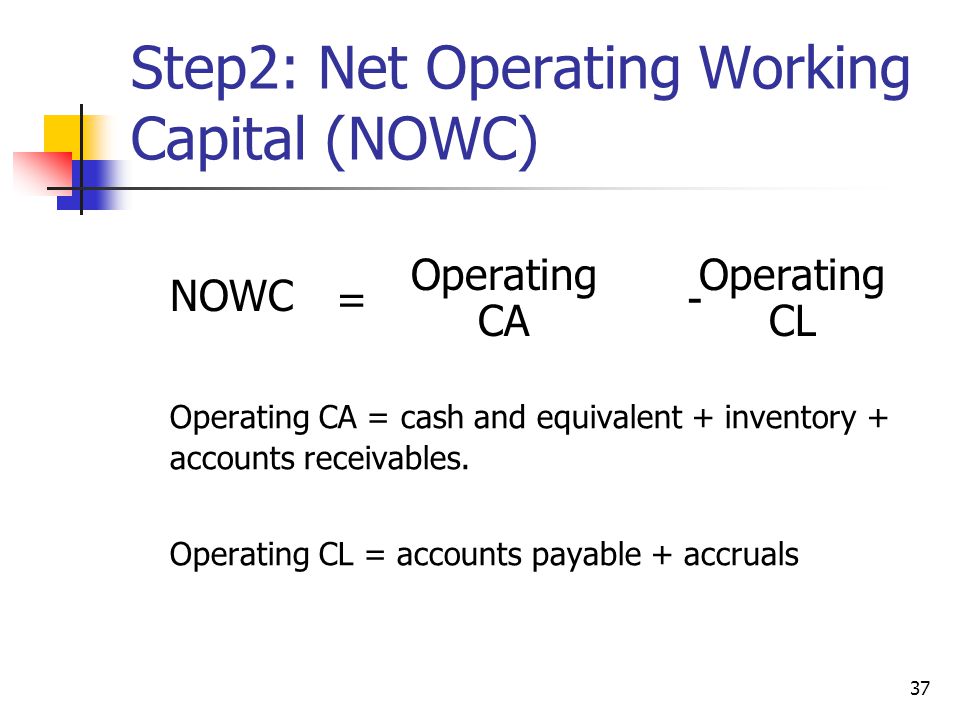

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. Also known as working capital. Operating capital is defined as the cash required for running the daily operations of the company.

Non-cash working capital NCWC is calculated by taking all current assets net of cash and subtracting all current liabilities. Usually during due diligence the targets historical NCWC is calculated on a monthly basis for two to three years to understand how much working capital the business needs to support ongoing operations. The analysis performed on net working capital together with the adjustments identified serves as the basis for a detailed definition of net working capital in the purchase and sale agreement.

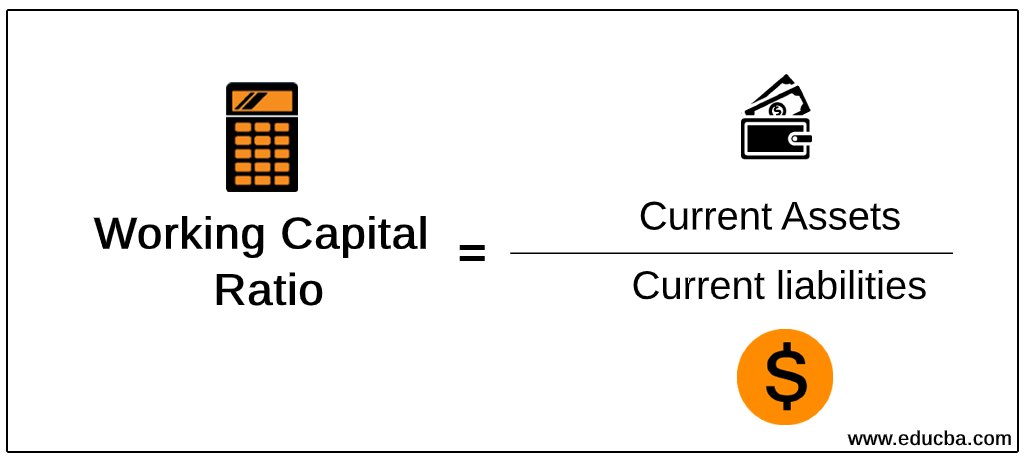

It is a measurement of a companys liquidity and looks like this. Net Working Capital NWC Operating Current Assets Operating Current Liabilities The reason is that cash and debt are both non-operational and do not directly generate revenue. The classic definition of net working capital is current assets minus current liabilities.

The definition is articulated by way of stating clearly what account balances are included in andor excluded from net working capital. A net working capital formula is an equation that measures a companys ability to pay off current liabilities with assets. Current assets include cash accounts receivable and inventories and exclude marketable securities.

What Is the Operating Expense Formula. --The incremental net operating working capital intensities are 262 236 and 307 in. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities.

Define Minimum Net Operating Working Capital. Current assets are generally those that are expected to generate cash within twelve months. Operating current assets are assets that are a needed to support the business operations and b expected to be.

Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating liabilities. Net Operating Working Capital Operating Current Assets Operating Current Liabilities Example Calculate total net operating capital for Best Buy Inc.

Net working capital is the aggregate amount of all current assets and current liabilities. Net working capital is a financial measure that determines if a business has enough liquid assets to pay its bills that are due in one. Operating working capital OWC is a financial metric designed to accurately determine a companys liquidity and solvency.

Define Net Operating Investment. The concept of operating working capital is a beneficial measuring stick for newer businesses. Operating working capital is defined as operating current assets less operating current liabilities.

Net working capital is intended to represent those assets and liabilities that are expected to have a short-term impact on cash and equity. Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses. In fact cash and cash equivalents are more related to investing activities because the company could benefit from interest income while debt and debt-like instruments would fall into the financing activities.

And How To Calculate It Why is net working capital important. Means as of the end of any of the Companys fiscal quarters and excluding the effect of discontinued operations the total of current assets minus current liabilities minus cash and equivalents plus current maturities of long- term debt including revolver balances included in current liabilities plus net property plant and equipment PP. It is similar to the basic concept of working capital in that it.

Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial. Gross working capital is equal to current assets.

Shall be determined by the Closing Date Balance Sheet and shall mean the Companys current assets including Minimum Cash cash and cash equivalents accounts receivables and prepaid expenses but excluding deferred tax assets minus the Companys current liabilities including accounts payable and accrued expenses but. This liquidity ratio demonstrates how able a company is to pay off its current operational liabilities with its current operational assets. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year.

Current assets - current liabilities net working capital. It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in.

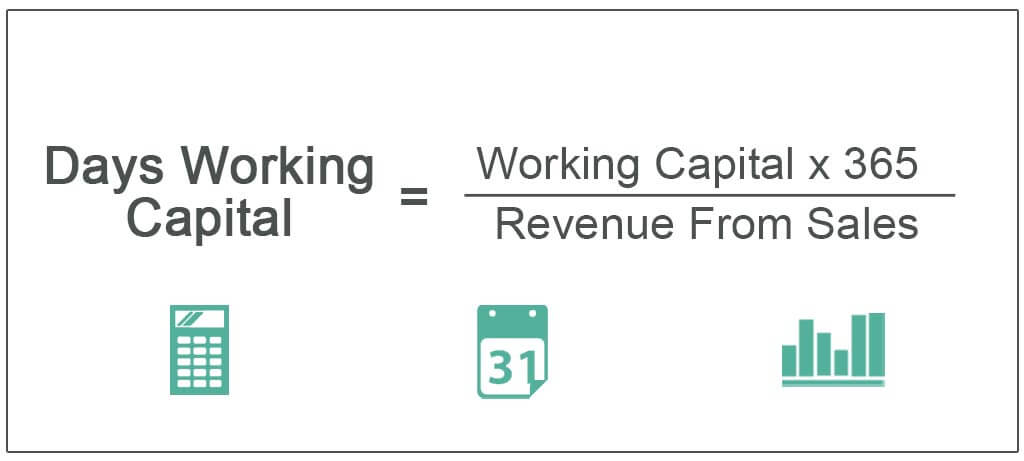

Days Working Capital Definition Formula How To Calculate

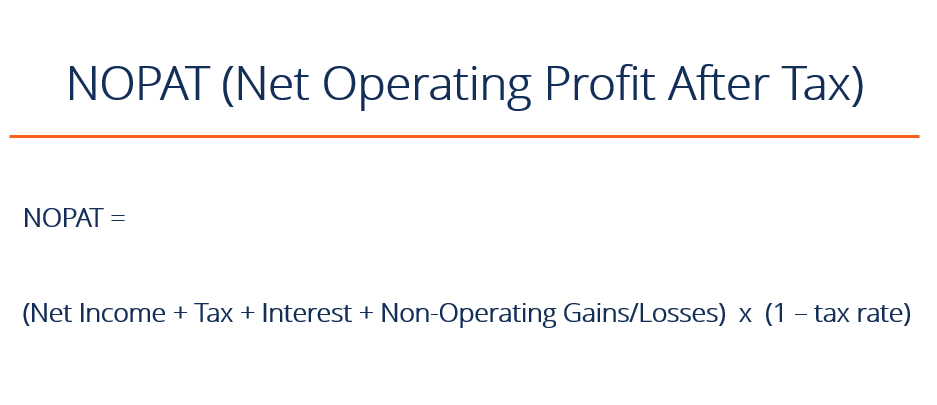

Nopat Net Operating Profit After Tax What You Need To Know

Working Capital Formula And Calculation Exercise Excel Template

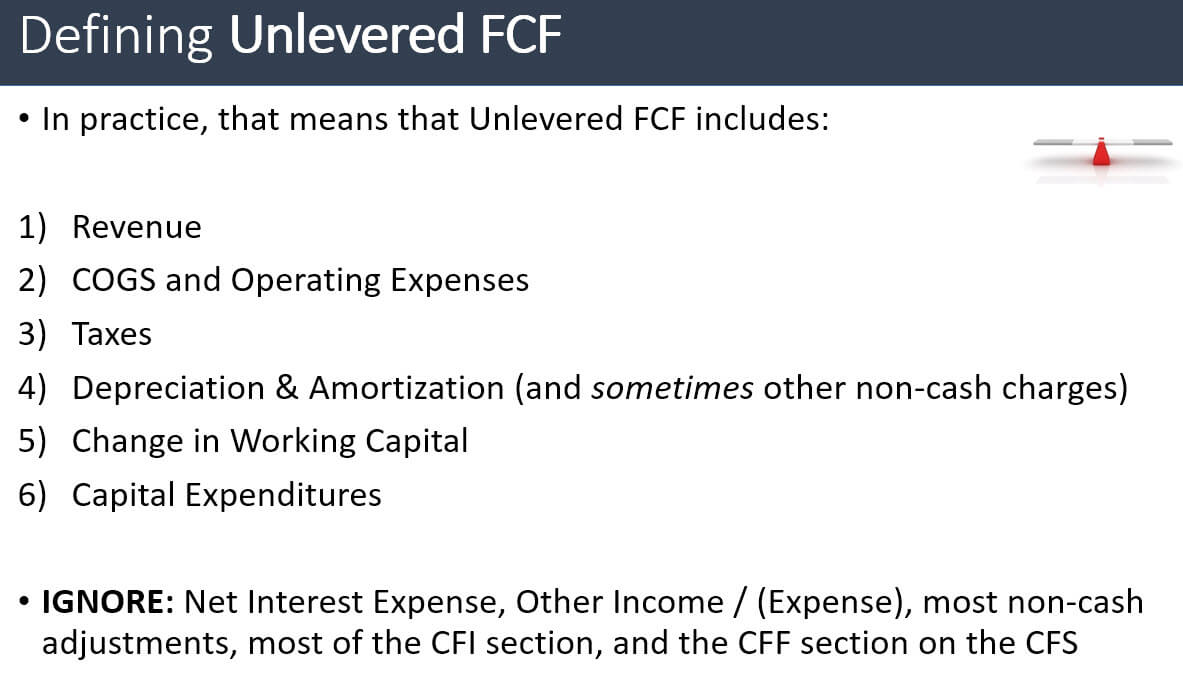

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

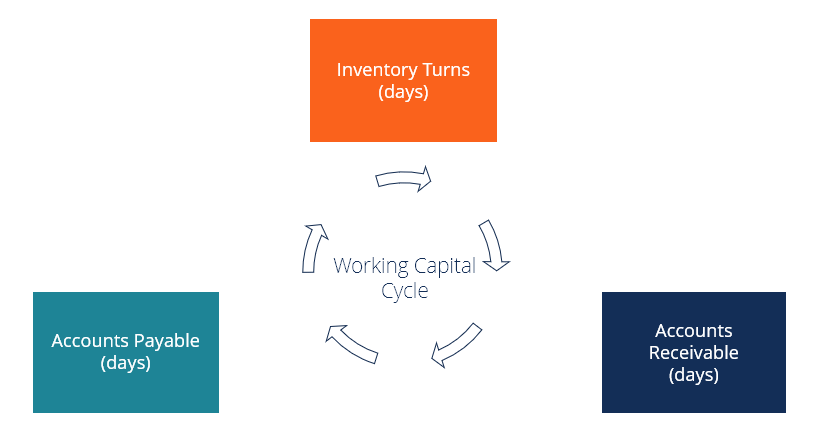

Working Capital Cycle Understanding The Working Capital Cycle

Changes In Net Working Capital All You Need To Know

Financial Statements Cash Flow And Taxes Ppt Video Online Download

Working Capital Define Importance Objective Policy Manage Finance

Working Capital Ratio Analysis Example Of Working Capital Ratio

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital What It Is And How To Calculate It Efficy

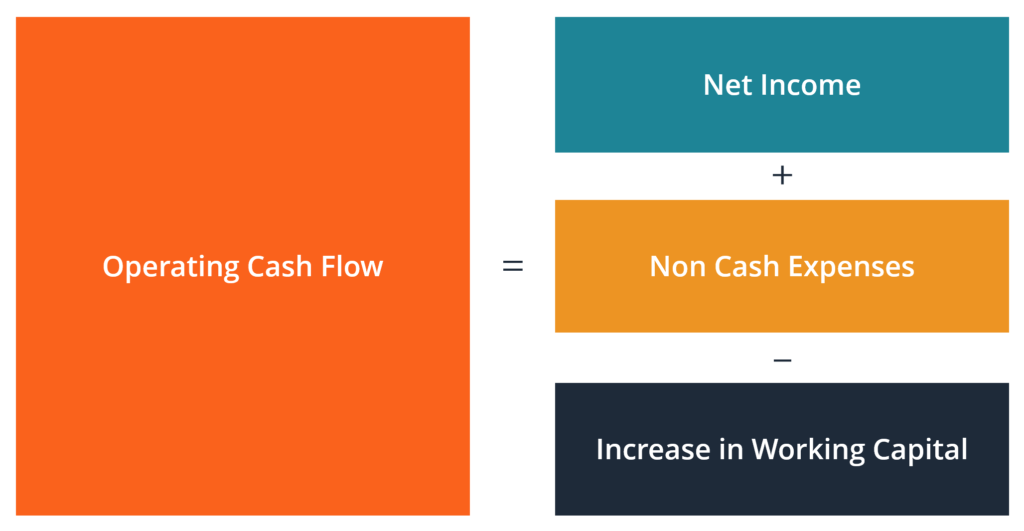

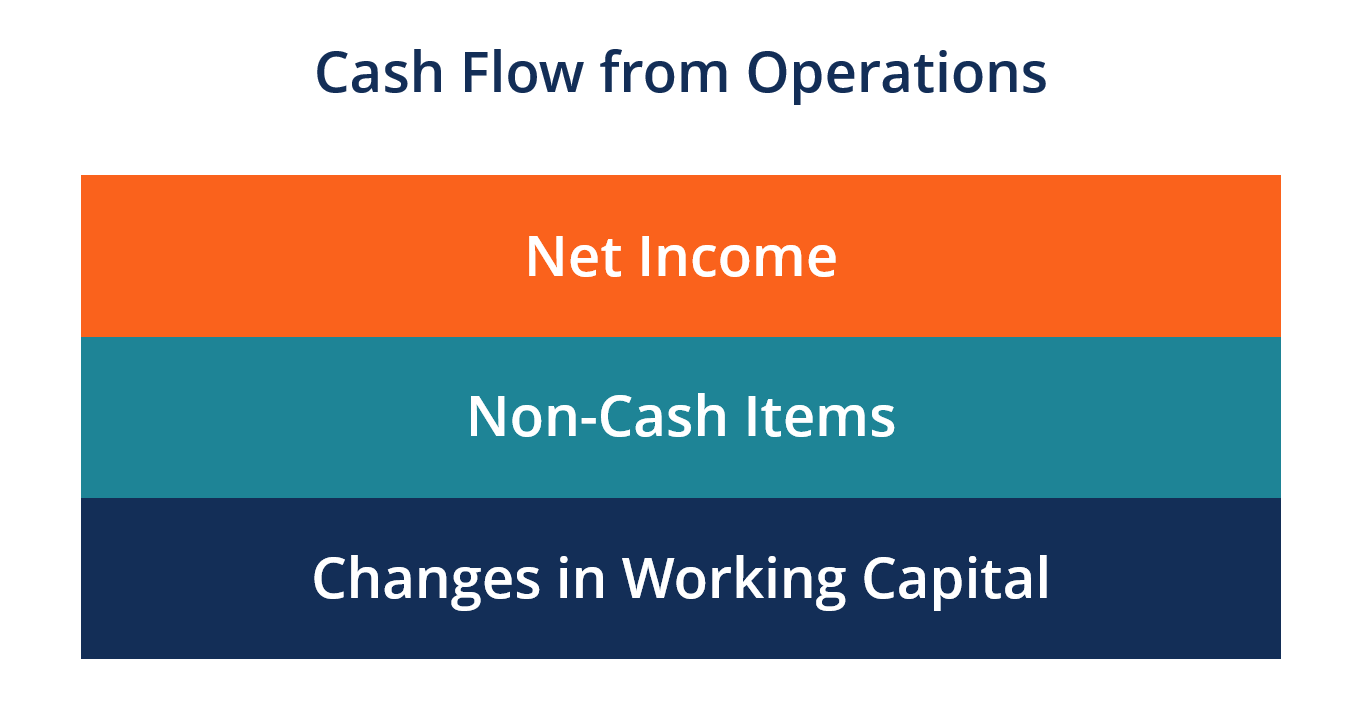

Operating Cash Flow Definition Formula And Examples

Cash Flow From Operations Definition Formula And Example

What Is Operating Working Capital Owc Net Working Investment

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)